Long term capital gains tax rates are 0 15 or 20 depending on your taxable income and. Yes besides sales tax excise tax property tax income tax and payroll taxes individuals who buy and sell personal and investment assets must also contend with the capital gains tax system.

Byrd And Chens Canadian Tax Principles 2011 2012 Edition

Byrd And Chens Canadian Tax Principles 2011 2012 Edition

This guide is not available in print or as a downloadable pdf portable document format document.

[PDF] Read Online And Download Capital Gains Tax Planning 201112. From 1954 to 1967 the maximum capital gains tax rate was 25. The guide to capital gains tax 2012 explains how capital gains tax cgt works and will help you calculate your net capital gain or net capital loss for 2011 12 so you can meet your cgt obligations. If you sell assets like vehicles stocks bonds collectibles jewelry precious metals or real estate at a gain youll likely pay a capital gains.

In 1978 congress eliminated the minimum tax on excluded gains and increased the exclusion to 60 reducing the maximum rate to 28. Long term capital gains tax rates in 2019 if you sell investments at a profit and youve held them for over a year heres what you need to know about taxes. Capital gains tax 201112 capital gains tax the chargeable gains of the tax year after deduction of capital losses available reliefs and the annual exemption are taxed at 18 basic rate income tax payers or 28 taxable income and gains exceed 35000.

These investments may take the form of a piece of real estate property like a house or a farm. Its the gain you make thats taxed not the amount of. Long term capital gains tax is a tax on profits from the sale of an asset held for more than a year.

The three long term capital gains tax rates of 2018 havent changed in 2019 and remain taxed at a rate of 0 15 and 20. Which rate your capital gains will be taxed depends on your taxable. Capital gains tax rates were significantly increased in the 1969 and 1976 tax reform acts.

There are links to worksheets in this guide to help you do this. It can also be a family business or even a work of art. Capital gains tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price. To understand the capital gains tax we must begin by understanding exactly what is meant by capital gainscapital gains is the income that a person gets from the sale of an investment.

Capital Gains Tax The Long And Short Of It Mymoneysage Blog

Capital Gains Tax The Long And Short Of It Mymoneysage Blog

Capital Gains Tax More Of A Threat Than You Think Telegraph

Capital Gains Tax More Of A Threat Than You Think Telegraph

Cost Inflation Index Cii How It Impacts Capital Gain Tax

Cost Inflation Index Cii How It Impacts Capital Gain Tax

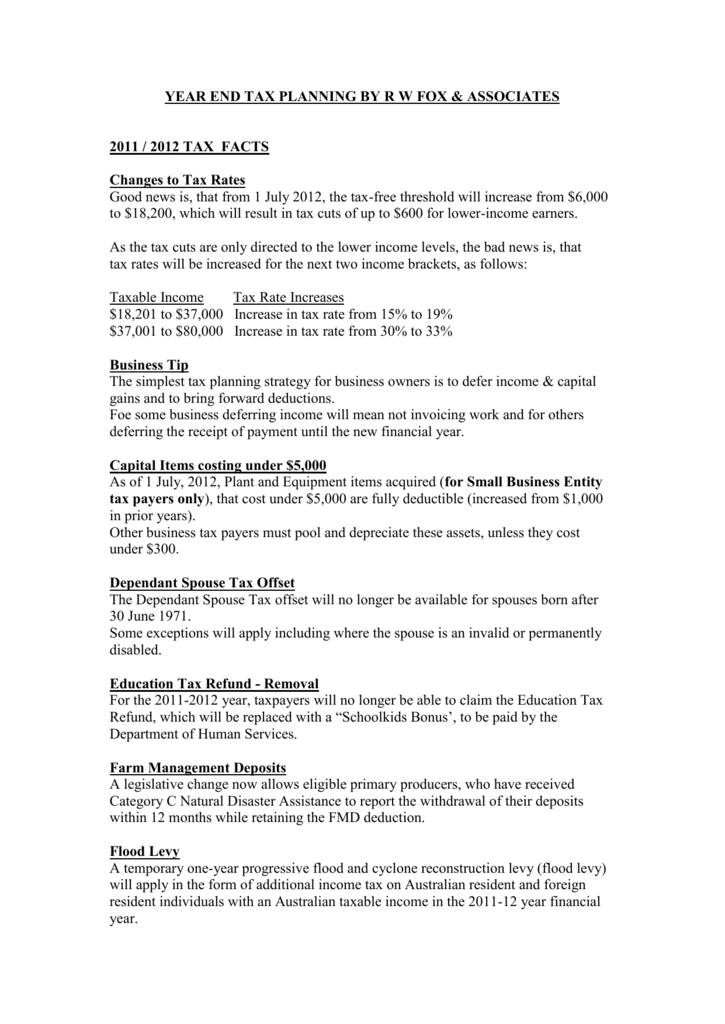

Year End Tax Planning 2012

Year End Tax Planning 2012

California Can Reform K12 And Medi Cal Or Face A Future Of

California Can Reform K12 And Medi Cal Or Face A Future Of

Should I Invest In 401k Or Roth Ira

Cost Inflation Index Cii Finance Ministry Notifies Cii

Cost Inflation Index Cii Finance Ministry Notifies Cii

California Prop 55 Extending Higher State Income Taxes For

California Prop 55 Extending Higher State Income Taxes For

Online Brokers My Cost Basis Information Didnt Transfer

Online Brokers My Cost Basis Information Didnt Transfer

Pay Less Tax With Your Investments Value Research The

Pay Less Tax With Your Investments Value Research The

How To Calculate Capital Gains And What Is Indexation

How To Calculate Capital Gains And What Is Indexation

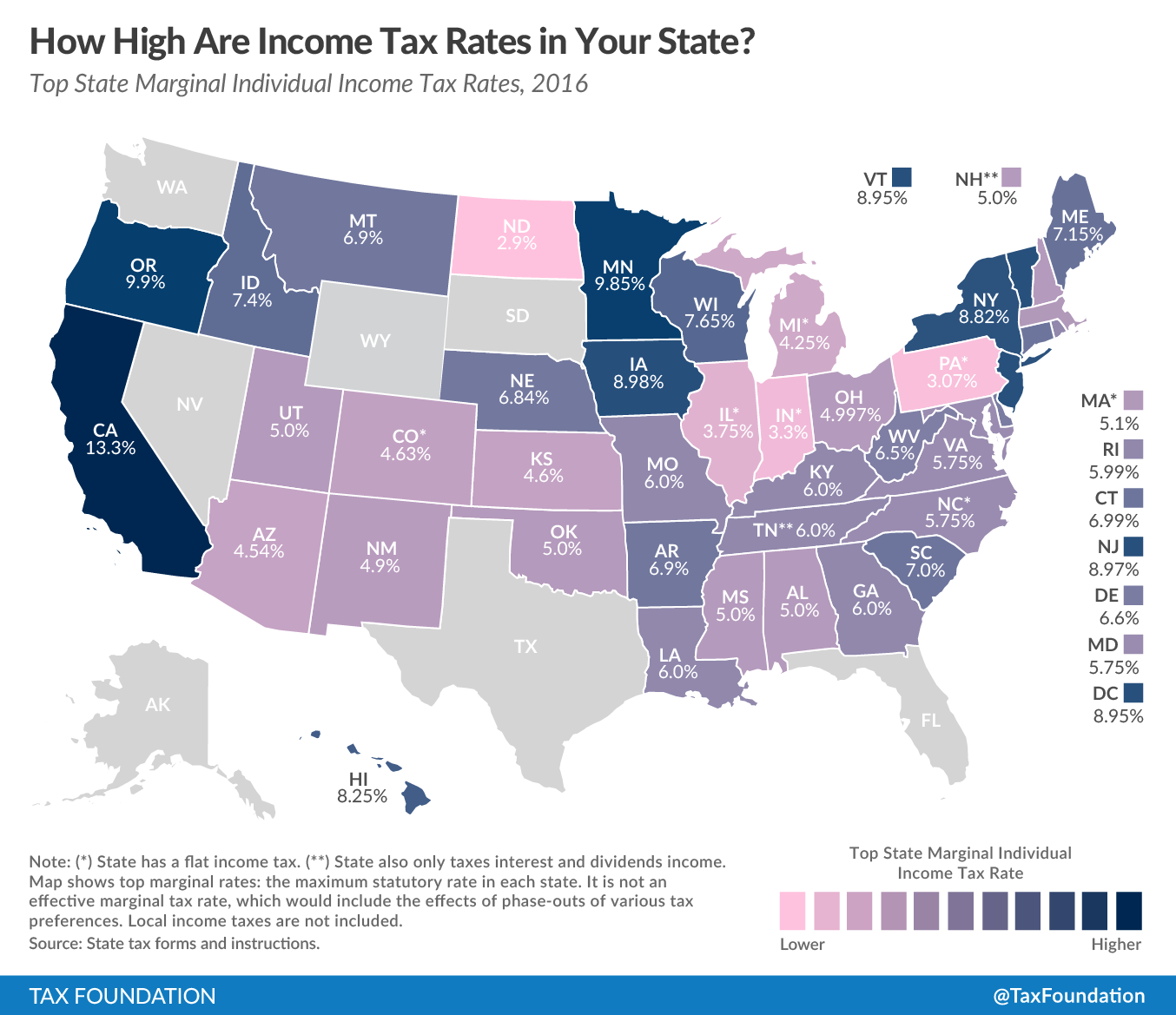

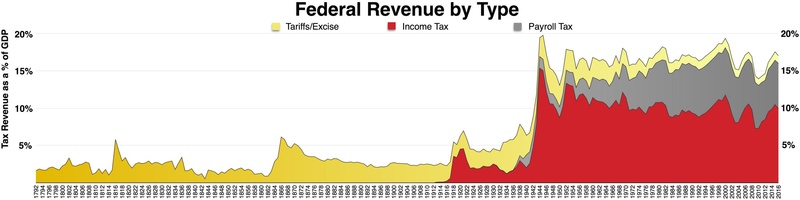

History Of Taxation In The United States Wikipedia

History Of Taxation In The United States Wikipedia

Money Northlondonhousewifecom

Money Northlondonhousewifecom

Impact Of Capital Gains On Eligibility For Need Based

Impact Of Capital Gains On Eligibility For Need Based

Total Uk Hmrc Tax Receipts 2019 Statista

Total Uk Hmrc Tax Receipts 2019 Statista